During this session, we discussed how the government taxes and spends as well as some useful research relating to this year’s Leaving Cert Economics project. For the first time ever, Irish economics students in secondary school are being tasked with taking on the role of a practising economist and this will represent 20% of their grade. You can see the full recording here:

Understanding fiscal policy

The government takes money in primarily through taxes. The two main sources of tax are income tax and VAT (Value Added Tax). The Department of Finance publishes the details of how much money it collects in the “Exchequer Statement[SH1] ”. For example, the August 2020 document says

“Tax revenues of €3,095 million were collected in August, bringing the total tax revenue for the year to date to €34,248 million.”

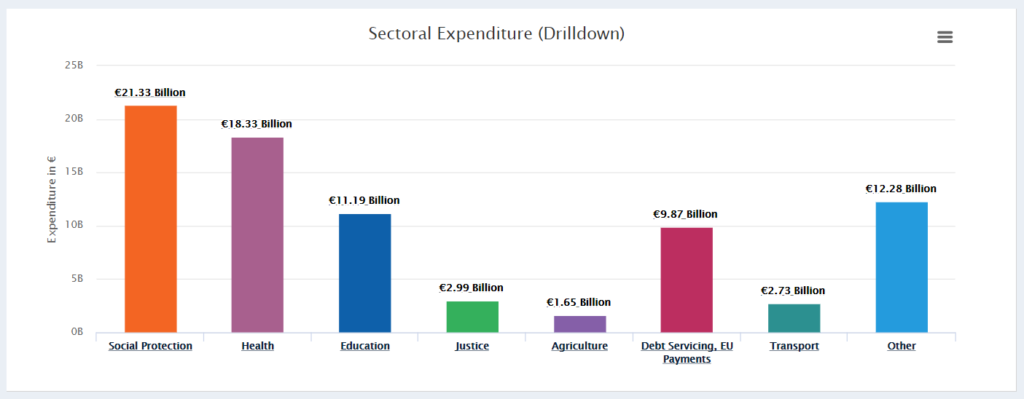

On the other hand, the government makes decisions how to spend the money collected in taxes, borrowed from the bond markets and any other income it collects. We can see the results of those decisions visually on the web site https://whereyourmoneygoes.gov.ie/en/

For example, out of the €80.4 billion expenditure we can see that the two largest areas are social protection and health. If you visit the site and double click on any of the columns, you can drill down further.

For example, out of the €80.4 billion expenditure we can see that the two largest areas are social protection and health. If you visit the site and double click on any of the columns, you can drill down further.

Sustainability of Government Policy

However, of course, as a government, it’s not easy to decide what you’re going to spend the money on. There are always a lot of requests for very worthy causes. Should the government put more money into health or education? Put more money into rural Ireland or build up the cities? Offer more incentives to foreign direct investment companies who offer high paying jobs or stimulate Irish indigenous business who may take longer to grow?

(Note: For those of you using the Positive Economics textbook[SH1] , you will see a full discussion about this in Chapter 12)

This is what the essence of sustainability is all about. Specifically, in our textbook, we refer to sustainability in the following way:

There are some useful resources that have been recently published to investigate government policy and understand the challenges it faces in putting Ireland on a sustainable footing including:

- National Economic and Social Council (NESC) – Responding Sustainably

This document is referenced in the Leaving Cert project document itself. It’s a useful summary of the considerations that need to be given to enabling the country’s people, the environment and the economy to grow in a way that’s sustainable. It talks through the things that have been spoken about for a long time (e.g. global climate change) as well as the new discussions that the COVID 19 restrictions brought about (e.g. mass flexible working).

This was a short piece written by Cliff Taylor in the Irish Times with five graphs that simply convey where Ireland is at economically arising from all the changes that have happened over the past six months. The visuals hold a lot of information and are good examples of how to explain key economic data clearly.

This is a comprehensive document that outlines the government’s plan for the economy, healthcare and society in the months ahead. It gives a short outline of initiatives like the Temporary Wage Subside Scheme, the Stay and Spend staycation incentive and some ideas relating to eHealth innovation.

Each of these links refer to different pieces of “secondary research” i.e. data that has been collected and analysed by somebody else (and thus you’re getting it “second hand”). If you’re referring to reports, web site, news reports or other secondary research sources, make sure that you reference your sources.

We would be delighted if you could join us for our next Positive Economics webinar. If you register for our newsletter, you will be kept up-to-date on all of our online events and new articles, podcasts and videos.